Green Bonds: Why life cycle assessment is useful?

03 June 2021

Green bonds have emerged as a key instrument to fund projects contributing to climate change mitigation or environmental protection. Yet, there is currently no consistent, robust and comparable standard for estimating the environmental impacts of green bonds. This may hamper the growth of sustainable finance. Using life cycle assessment (LCA) can provide a comprehensive environmental assessment of projects throughout their life cycle.

In an in an open access paper, researchers from the Environmental Research and Innovation (ERIN) department of the Luxembourg Institute of Science and Technology (LIST) examined how effective green bonds are at decarbonising the economy and if there are potential unseen side effects.

Data scarcity and heterogeneity

Undoubtedly, green bonds play an increasing role in financing investments for development and climate transition.

As no global standard exists to report information, a number of initiatives emerged to reduce the risk of greenwashing and increase transparency. They include the Green Bond Principles (GBP), the Climate Bond Initiative or approved verifiers. In addition, it is market practice that issuers hire a second-party opinion provider to check and rate the green bond issuance from an environmental perspective. Despite these efforts, the industry remains self-regulated.

In this context of data scarcity and heterogeneity in use of proceeds, is there any potential for LCA to support a more robust reporting framework? If yes, how does it compare to conventional accounting? And finally, beyond carbon accounting, can LCA give any indication of wider environmental sustainability consequences?

To limit the increase in global average temperature to 2 °C, funds directed towards sustainable projects need to increase substantially.

Lack of appropriate indicators and metrics increase the risk of greenwashing and present a lost opportunity to direct funds towards the most suitable projects.

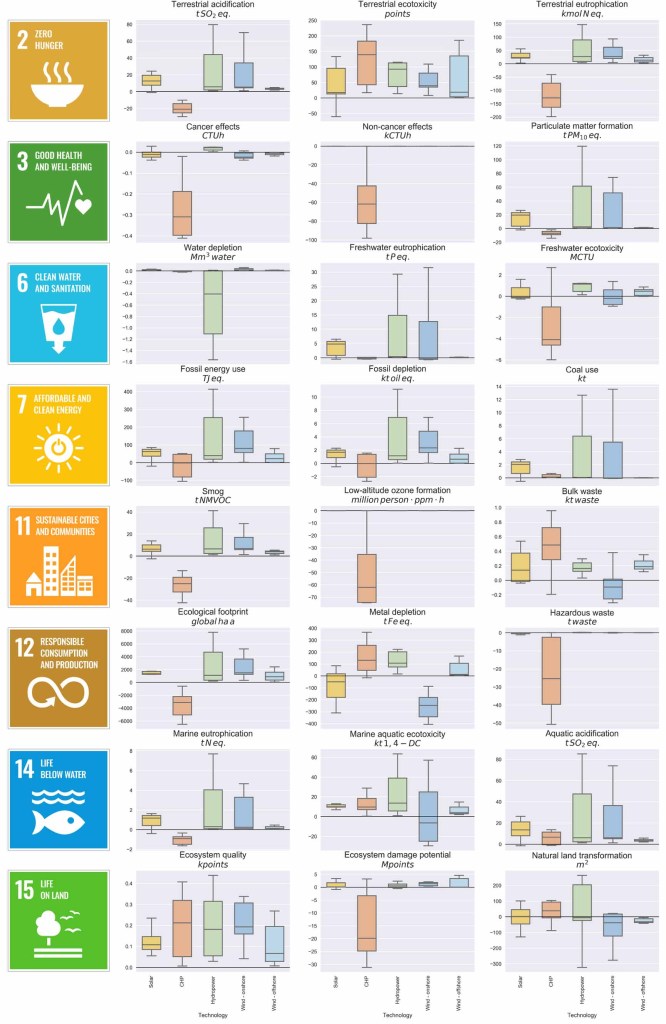

Technologies on a level playing field and wider inclusion of environmental impacts

Following a life cycle perspective to assess the environmental impacts of a green bond is useful for two reasons. First, it puts technologies on a level playing field. Indeed, some technologies have relatively low emissions during the use phase but at the cost of relatively higher emissions during the construction or end-of-life phase.

Second, linking projects to LCA databases allows for the inclusion of environmental impacts beyond greenhouse gas emissions. While some investors may only be interested in climate change mitigation, others may want to achieve climate change mitigation with as little cost to other environmental goals as possible.

Life cycle assessment-based rules may prove the right tool to measure sustainability

The recently agreed-upon EU framework for sustainable finance explicitly requires economic activities to provide a ‘substantial contribution’ to one of the six listed environmental objectives while not doing ‘significant harm’ to any of the other environmental objectives for the economic activity to be deemed ‘environmentally sustainable’.

The draft proposal for the EU Ecolabel for Financial Products states that bond funds must show a share of 70% in fixed-income instruments that align with the Taxonomy to receive the EU Ecolabel. As elements of this framework become legally binding in the future through delegated acts, conducting this kind of assessment over multiple indicators may become necessary.

In this context, LCA and the ready infrastructure of LCA databases and methodologies can provide the tools to meet future reporting requirements.

Meet the researchers

Extracts from Shades of green: life cycle assessment of renewable energy projects financed through green bonds. Letter by Thomas Gibon et al 2020 Environ. Res. Lett. 15 104045

This research is part of LIST REFUND project.